Note (Work in Progress)

This article is currently being written and is incomplete.

Important (Disclaimer)

This is not investment advice and the perspectives presented are purely personal. Past performance is not indicative of future results.

Introduction

Tip (Model Disruption)

The patrimonial architecture presented here marks a clear break with the “French saver consensus”. Where popular wisdom advocates for stone (real estate) and nominal security (euro funds), this strategy embraces volatility, technology, and digital scarcity.

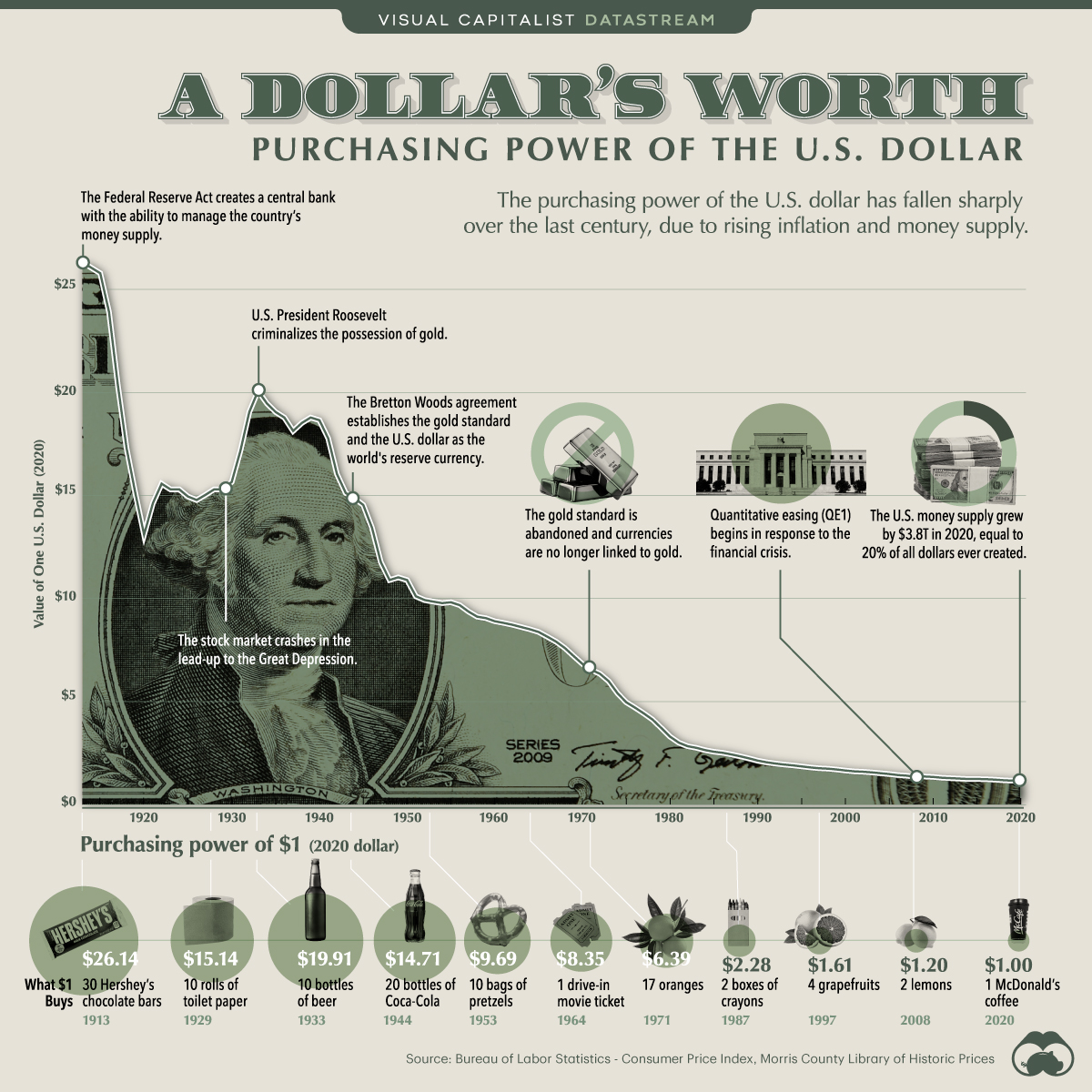

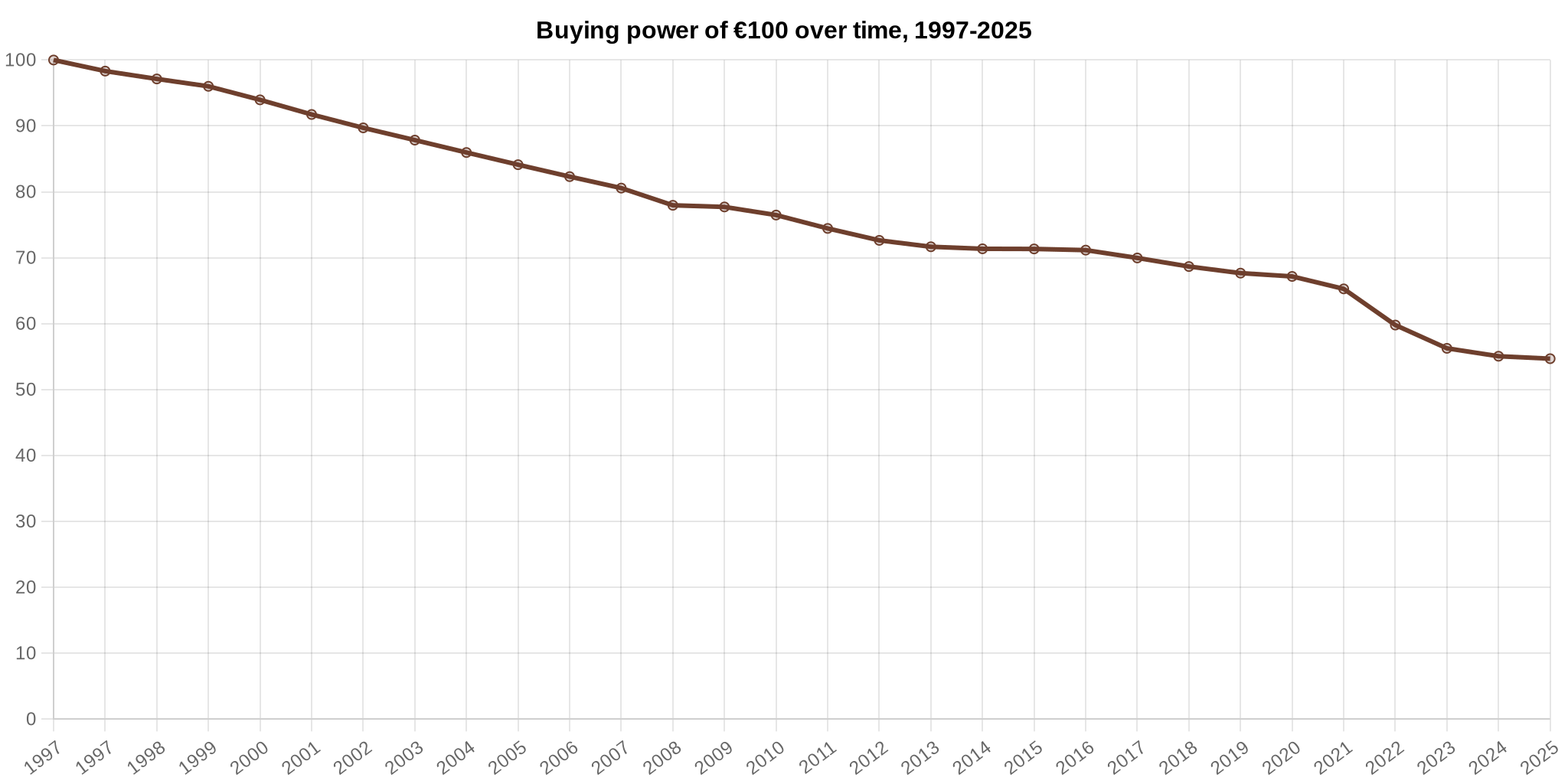

In a world of financial repression and structural monetary inflation, the “safety” of guaranteed assets is an illusion that erodes purchasing power. Inflation is not simply an increase in prices; it is a tax on uninvested savings. Regulated savings accounts primarily serve the State’s interests and often offer a real return that is negative. Keeping money in a current account beyond what is strictly necessary is a fundamental mistake, as it is the banks that profit from your savings.

The first question to ask yourself:

What is my objective?

For my part, my goal is to reach at least €800,000, which corresponds to the threshold of financial freedom according to theory.

Note (The 4% Rule (Trinity Study))

With a diversified portfolio, you can theoretically withdraw 4% of the initial capital each year (adjusted for inflation) without depleting the capital over 30 years.

For a capital of €800,000 placed at a gross rate of 4%, the annual gross income is €32,000. Applying a “Flat Tax” revalued at 31.4%, the amount of tax amounts to €10,048.

The calculation of the annual net income () is therefore obtained as follows:

Which corresponds to a monthly net income ():

To reach this goal at 50, the key will not only be asset performance, but also behavioral discipline in the face of inevitable market crashes. This is why 90% of my portfolio is “passive”.

Passive vs Active Management

The fundamental distinction between passive and active management lies in the performance objective and the investor’s role vis-à-vis the market. Passive management accepts the idea that consistently beating the market is extremely difficult; it therefore aims simply to replicate the average performance of an index (like the Nasdaq-100 via your Amundi PUST ETF) by minimizing fees and human interventions, which makes it statistically more performing over the long term for the majority of investors See the SPIVA study.

Conversely, active management (like my cash pocket to seize opportunities or actively managed funds such as the BlackRock ESG Multi-Asset ETF) attempts to outperform this benchmark index through arbitrary selection of securities based on fundamental or technical analyses, an approach that generates higher fees and increased volatility, justified only if the manager manages to generate Alpha, that is to say an excess return relative to the risk taken.

My opinion on real estate

The choice not to invest in physical real estate for the moment is a balance sheet and mobility decision (I specify that I have been an owner and have sold). Real estate is an additional cognitive load, often contains charges, co-ownership fees, agency fees, etc. It is illiquid and entry fees require years of amortization. In a context of geographical mobility, real estate anchoring becomes a liability. Moreover, the personal contribution immobilized in a primary residence is “dead capital” that does not compound, unlike an investment in the stock market maximizing the leverage of compound growth.

Also, the French regulatory context being uncertain, especially around LMNP (Non-Professional Furnished Rental), property tax, etc., I prefer to concentrate on more stable assets.

Some discussions on the subject:

Subscriptions

Portfolio performance depends as much on the savings rate as on asset yield. The modern economy, based on subscriptions, creates passive outflows that hinder accumulation. A quarterly audit to cancel any non-essential service is imperative. The goal is to keep the current account close to zero, with every surplus euro put to work immediately. To have a better view of your current subscriptions, you can use the Finary solution with 1 month of premium free via this link:

Debt and Credits: Leverage vs. Burden

In an aggressive accumulation strategy aiming for financial independence, liability management requires iron discipline where debt is tolerated only if it acts as a mathematically positive lever for enrichment. It is imperative to distinguish productive debt, contracted to acquire assets whose net return exceeds the cost of credit, from toxic debt related to consumption or depreciating assets that mortgage your future income and slow down the mechanics of compound interest. In the current context of normalized rates, the use of credit must be strictly reserved for investment opportunities offering a clear and secure yield differential, while the systematic elimination of all other liabilities allows maximizing free cash flow to fuel your investments in stocks and cryptocurrencies. For my part, I have chosen not to go into debt to invest.

My opinion on ETFs

I would like to dispel a common misunderstanding: ETF does not necessarily mean Passive Management.

An ETF (Exchange Traded Fund) is simply a financial asset that replicates an index. What is put inside this envelope determines the strategy:

- Passive ETF: It replicates an index (ex: S&P 500 or Nasdaq-100). The goal is to do as well as the market.

- Active ETF: A manager selects titles to attempt to beat the market.

Similarly, the boundary is blurred: a “passive” index like the S&P 500 is actually managed by a human committee that actively decides which companies enter or exit according to strict rules. Choosing to invest 100% on the Nasdaq-100 is in itself a decision of active management for allocation, betting on the outperformance of US tech against the rest of the world.

If your risk aversion is too strong, you can opt for a passive ETF on the S&P 500 or more diversified like the MSCI World, but I advise you to think carefully about this decision.

Bonds

The notable absence of government bonds in my portfolio marks a voluntary break with the traditional 60/40 model (which your bankers advise you in particular for life insurance), which has shown its limits in an inflationary environment where the correlation between stocks and bonds tends to converge. Rather than using sovereign debt (who trusts France https://horloge-de-la-dette-publique.com/) as a performance engine, often anemic in real return, this asset class finds no place in my strategy. These instruments then act solely as remunerated quasi-liquidity, allowing to secure capital intended for market opportunities without suffering the volatility of long rates nor the monetary erosion of dormant cash.

Note

For more information on bonds, I invite you to consult this link: https://educationfinancieredelentrepreneur.fr/investir-facilement-2025-comment-allouer-vos-actifs-modele-4-cadrans-charles-gave-strategie-resiliente/

Fiscal Envelopes

For a French tax resident, optimization involves thoughtful use of available envelopes:

-

PEA (Plan d’Épargne Actions) The investment account to fill first:

- Role: Long-term capitalization on Europe.

- Taxation: After 5 years without withdrawal from this envelope, you are exempt from capital gains taxes. Only the 17.2% social contributions remain due to the state during the annual income tax declaration.

- Constraint: Limited to European stocks, partially circumvented via synthetic ETFs (SWAP) to access the S&P 500 or Nasdaq for example. The owner must be of age.

-

PEE (Plan d’Epargne Entreprise) If your employer offers a PEE or your company is registered and you have employees:

- Role: Optimization of remuneration and employee savings. The main objective is to capture the matching contribution (money offered by the employer in addition to your payments) and to place profit-sharing and participation bonuses without them being subject to income tax.

- Taxation: Exemption from capital gains tax after 5 years (similar to PEA). Only social levies (17.2%) remain due on gains upon withdrawal.

- Constraint: Sums blocked for 5 years (except in cases of legal early release such as purchase of primary residence, marriage, end of employment contract, etc.). The choice of investment vehicles (FCPE) is limited to those selected by the company.

-

Life Insurance (Assurance Vie)

- Role: It serves primarily as a transmission tool outside succession (to protect a spouse or loved ones without kinship) and as a “super-savings account” to secure gains with softened taxation. It is also the only envelope allowing access to the Euro Fund (guaranteed capital) and paper real estate (SCPI) without immediate tax friction.

- Taxation: In case of life (Withdrawals): The optimum is reached after 8 years of holding. You then benefit from an annual allowance of €4,600 (€9,200 for a couple) on withdrawn gains. Beyond that, they are taxed at a reduced rate of 7.5% (plus social levies) as long as your payments remain under €150,000. Before 8 years, it’s the classic “Flat Tax” of 30%.

In case of death: For premiums paid before 70, each beneficiary benefits from an allowance of €152,500 totally exempt from inheritance tax. - Constraint: Unlike the PEA or CTO where holding is often free, Life Insurance charges annual management fees that mechanically erode compound performance over the long term. Moreover, although the money is always available, the punitive taxation before 8 years acts as a psychological brake on liquidity.

-

CTO (Compte Titres Ordinaire) For investment in assets not available in PEA and for active management:

- Role: Access to assets on a global scale without constraints (US stocks directly, thematic non-UCITS or specific ETFs, Small Caps). The owner can be a minor.

- Taxation: Flat Tax (30%) but total liquidity and flexibility.

- Constraint: Absence of capitalizing tax envelope and high taxation (tax due on each cession) and increased administrative complexity if using a foreign broker (manual declaration of accounts and income).

-

Crypto Wallet (Cold Storage / Exchange):

- Role: Holding cryptocurrencies outside the traditional banking system. We will see later that this is not necessarily a good idea.

- Taxation: Flat Tax (30%) but total liquidity and flexibility.

- Constraint: Risks of partial or total loss of capital stored on your wallet, compromise or loss of the exchange/wallet and responsibility for managing your portfolio.

Holding cryptocurrencies is one thing, but setting up a contingency plan is another, especially to anticipate a health emergency or organize one’s succession. Today, the management of your assets and their access falls entirely on you especially for cryptos, which implies real risks of partial or total loss of capital stored on your wallet.

Facing this complexity, the BlackRock ETF that replicates the performance of the bitcoin price (available here: https://www.ishares.com/us/products/333011/ishares-bitcoin-trust-etf) offers a serious alternative. Its main advantage lies in its status as a standard financial asset: it requires neither wallet nor specific exchange platform, thus considerably reducing the risks of technical compromise.

One must not forget that in France, no one is really safe from a physical robbery for their wallet. Free consultation of transactions on the blockchain, combined with computer hygiene (OpSec) often non-existent or fragile, can lead to unpleasant situations like for this couple sequestered in Charente-Maritime (https://www.franceinfo.fr/faits-divers/enlevements/cryptomonnaie-un-couple-sequestre-en-charente-maritime-et-plusieurs-millions-d-euros-derobes_7690165.html), which recalls that these risks do not happen only to others.

DCA or DVA

Let’s take the case where you receive a bonus and/or have a sum of cash. Would you invest it directly (lump-sum)? Two more nuanced approaches exist: DCA (Dollar Cost Averaging) and DVA (Dollar Value Averaging).

Regarding progressive investment methods, DCA (Dollar Cost Averaging) and DVA (Dollar Value Averaging) differ mainly on the flexibility of the amounts invested. DCA is a mechanical and psychologically neutral strategy that consists of investing a fixed sum at regular intervals (for example €50 per week on Bitcoin), which allows smoothing the cost price by buying as many units when prices are low as when they are high, without ever worrying about the total valuation of the portfolio at a given time T.

DVA, on the other hand, is a more complex strategy that aims for a progression of the total portfolio value; the investor sets a valuation target for each period and adjusts their contribution accordingly, which forces them to invest massively more cash if the market drops (to make up the gap) or to invest less, or even sell, if the market rises too quickly, making cash management much more constraining than the simplicity of DCA, but offering a better return over the long term.

Main Allocation (Nasdaq-100)

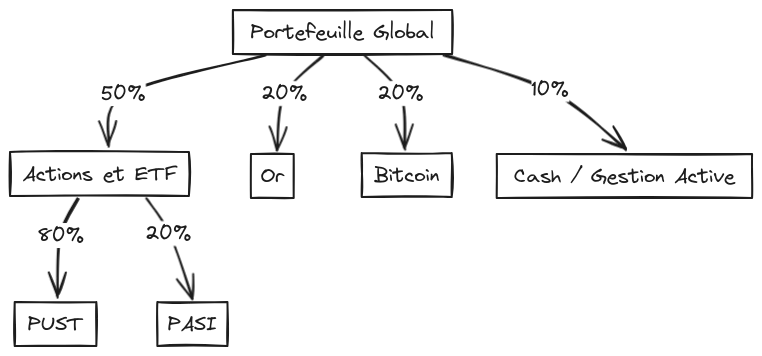

The main allocation of my wealth relies on the best performer index of the 21st century: the Nasdaq-100, in PEA via the ETF Amundi PEA Nasdaq-100 (PUST).

The choice of the Nasdaq-100 is a recognition of American economic domination. Companies like Microsoft, Apple, or Amazon and more broadly the Magnificent 7, have become the utility infrastructures of the global economy. They have solid balance sheets allowing them to finance unlimited R&D.

This interactive map allows us to concretely see the performance and impact of the largest market capitalizations (Magnificent 7) on the US market.

Technical Details of the ETF (PUST):

- ISIN:

FR0011871110 - Structure: Synthetic replication ETF. The fund holds a basket of European stocks and swaps its performance against that of the Nasdaq-100 via a swap.

- Fees (TER): 0.30%. Very competitive for US exposure in PEA.

- Dividends: Capitalizing (ACC). Dividends are automatically reinvested, maximizing compound interest without tax friction.

Warning (Volatility and Risk)

The Nasdaq-100 has a historical volatility greater than 20%. Drops of -30% are possible. I see a long time horizon greater than 30 years.

Everyone constantly tells us to “diversify” our asset portfolio. It is not uncommon to see threads on finance forums questioning the diversification of their portfolio and even wishing to “over-diversify”. Multiplying the number of lines in your portfolio is a false good idea. This makes your management longer and more complex, with potentially less controlled fees and there is also a risk of overlap. Many people’s portfolios present overlaps, meaning financial assets “duplicating” each other since they are correlated to the same market, sector, geography, or even cryptocurrency.

To summarize simply, concentrating means having a potential better return than multi-country or even global diversification with, in counterpart, much more risk.

Bitcoin and the devaluation of fiat currencies

Tip (DCA Strategy)

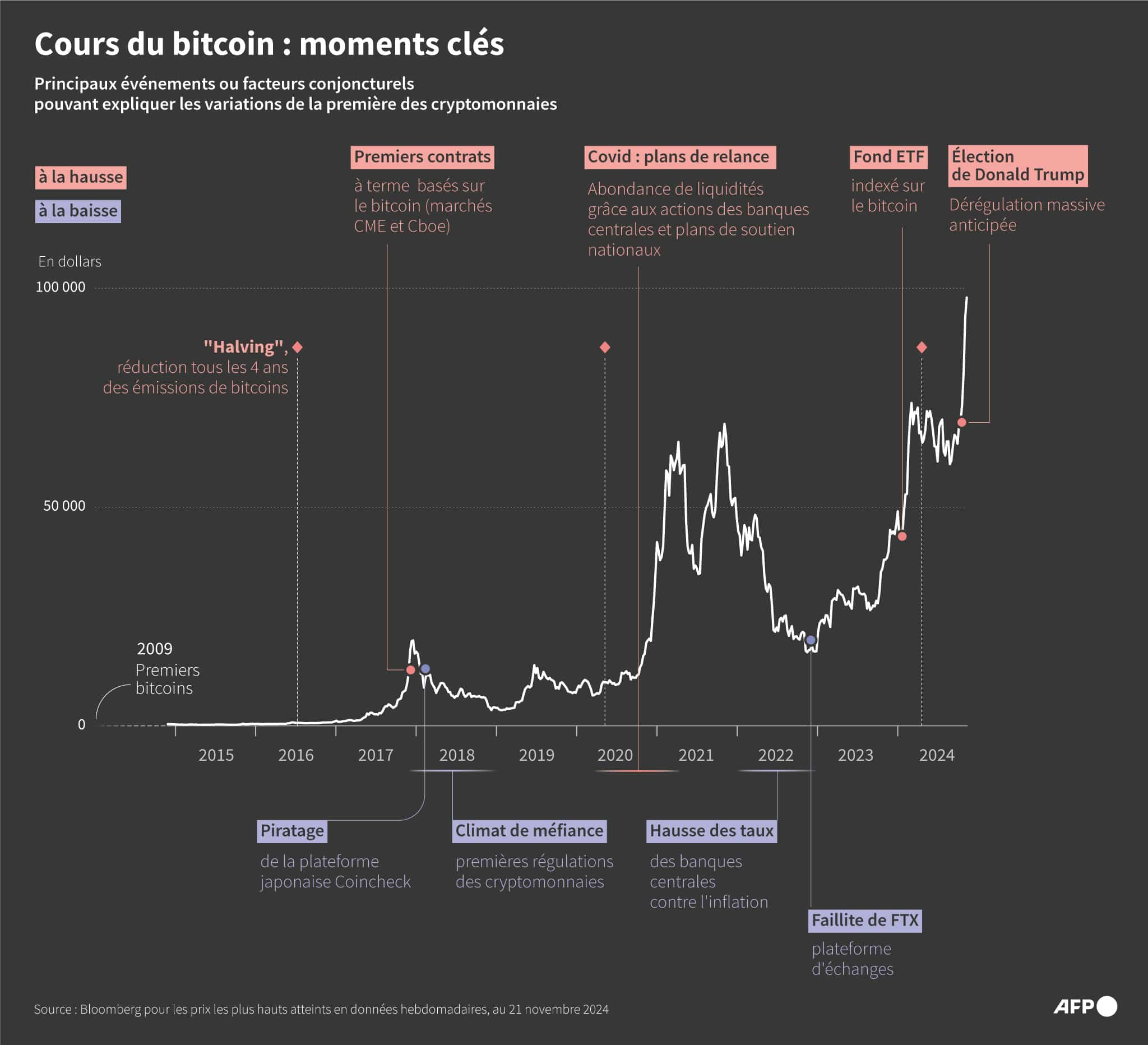

I make an automated weekly purchase (DCA), which allows me to smooth the entry point and eliminate the stress of “market timing”.

Bitcoin is envisioned as digital gold, a store of value with absolute scarcity (21 million units maximum). Institutionalization via Spot ETFs (BlackRock/ishares for example) and states that have officially integrated it validate the asset, creating structural demand against a decreasing supply (Halving). The goal is protection against monetary devaluation and positive performance asymmetry over the decade.

Dollar devaluation

Dollar devaluation Euro devaluation

Euro devaluation Bitcoin evolution

Bitcoin evolutionHistorically, fiat currencies (Franc, Dollar, Euro, etc.) have always devalued and become less valuable against real assets (Gold, Bitcoin, Real Estate, etc.)

Commodities and Gold

Gold constitutes an essential strategic protection in the current economic context, marked by persistent geopolitical tensions and uncertainties about public debt which fuel volatility in traditional markets. Gold imposes itself not only as a historic safe haven against monetary erosion, but benefits above all from a new structural bullish cycle supported by massive institutional demand, notably from central banks seeking to diversify their reserves away from the dollar. In complement, industrial and critical raw materials, such as silver or rare earths, offer tangible exposure to the physical reality of growth themes, as they are essential and irreplaceable components of semiconductors, defense infrastructures and energy transition, thus creating a natural hedge against inflation while profiting from structural supply shortage in these key sectors.

Conclusion

If your cash is not invested, the currency (EUR/USD) will lose value and prices will increase, so your purchasing power will only decrease. If you invest in guaranteed return savings accounts (A, PEL, LDDS, LEP) you will lose less, but the potential return will remain low compared to assets like raw materials, ETFs/Stocks, cryptos, real estate, etc.

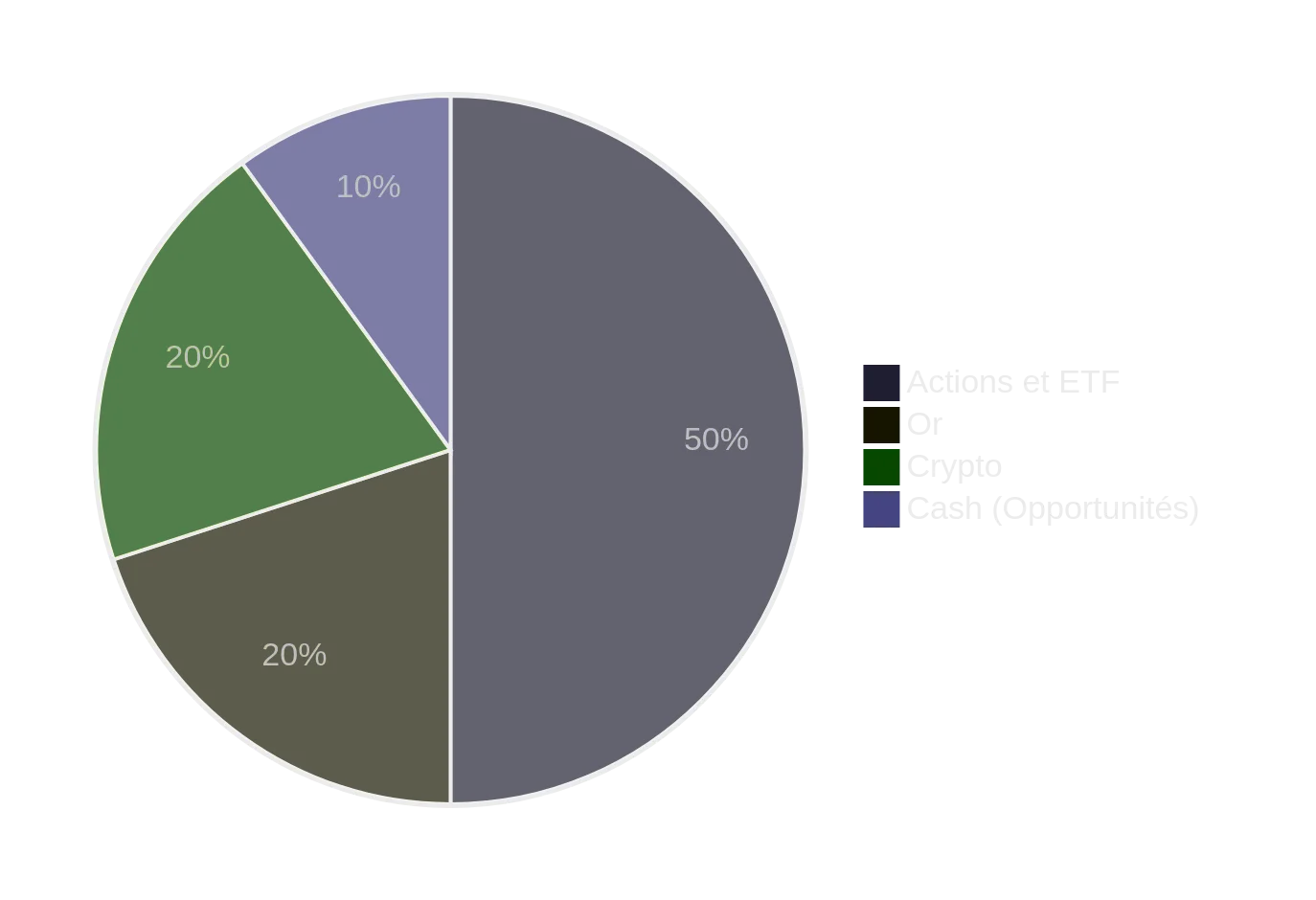

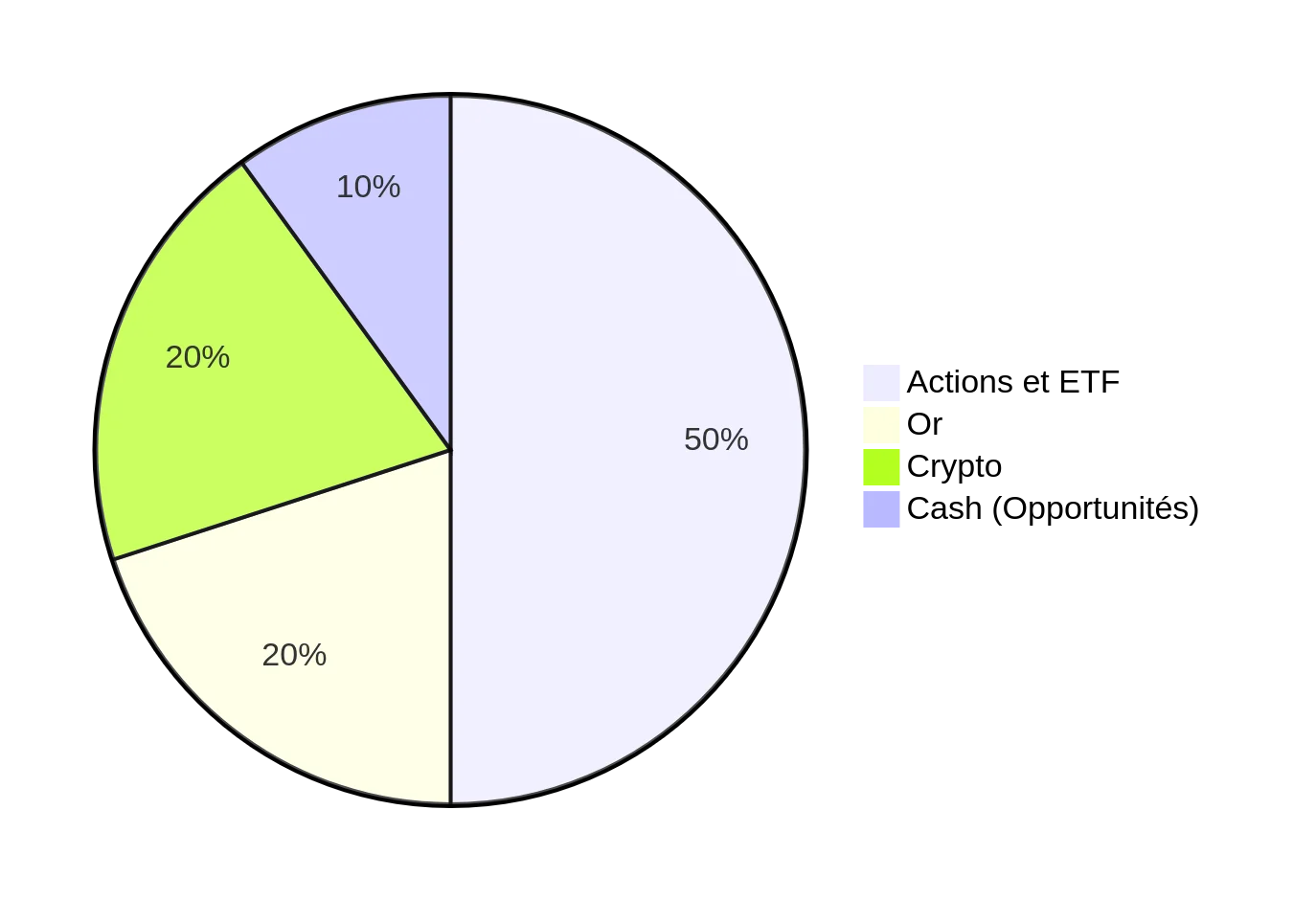

The US does not represent 100% of my portfolio; I am exposed to the Chinese market, I also possess bitcoin, gold and a cash pocket for active management as follows:

And here are the details of the values that constitute my portfolio:

References

A video that summarizes rather well what is said in this article:

Podcast on inflation, economy and investment:

ETFs:

Stocks I usually trade: